NFPCC Original Article: A Proxy Statement is Not a Bank Statement

If you do an internet search for “CEO pay”, you get 807 million hits, and most of those are “hits” on CEO pay. Some are warranted, and many are not.

Nowhere is this truer than CEO pay in the energy business in 2019. Many investors rotated out of public energy investments over the past several years, in spite of the fact that 2018 was an all-time record high for free cash flow generation by E&P companies (1). The result is E&P stock prices have dropped significantly the past three years. This dynamic disparity between shareholder returns and financial performance has manifested itself in compensation paid to CEOs in 2018 and further angered shareholders and the general public. In short, many E&P companies outperformed on operational and financial goals, and as a result paid above target bonuses to executive and rank and file employees, while shareholder returns took a deep dive at the end of 2018. When shareholders read proxy statements this past month, many questioned: How in the world did the compensation committee pay this to the CEO?

The NFPCC team decided to ask this question a little differently: Did the CEO earn (2018 realized pay) what the proxy statement said (2018 reported pay), and is that realized value tied to shareholder returns/losses?

NFPCC reviewed 35 E&P companies with market caps ranging from $1B-$5B and $5B-$25B. The results are interesting. Energy company shareholder returns in the past three years have not been good, median of -36% and -3%, respectively. However, CEO take home pay also paid the price. While there are a few high and low outliers, on average, E&P CEOs realized only a median of 51% and 67% of reported pay in the proxy statement. In short, a proxy statement is not a bank statement and NFPCC posits that pay for performance is working – unfortunately, both shareholders and executives are losing significantly right now. While the CEO pay debate will rage on, NFPCC encourages all debate participants, from SEC regulators to investors and all in between, to reconcile reported pay with realized pay to ensure pay for performance alignment is occurring.

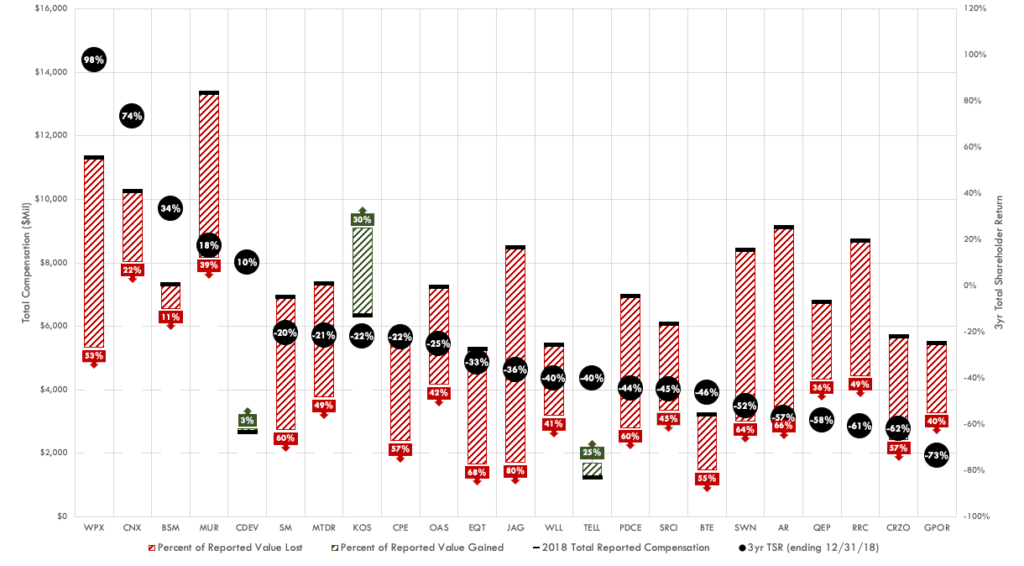

TOTAL CEO COMPENSATION (FY2018) | $1B – $5B Market Cap

Realized vs. Reported Value (as of 12/31/2018)

Median 3yr TSR: -36% | Median Realized as % of SCT: 51%

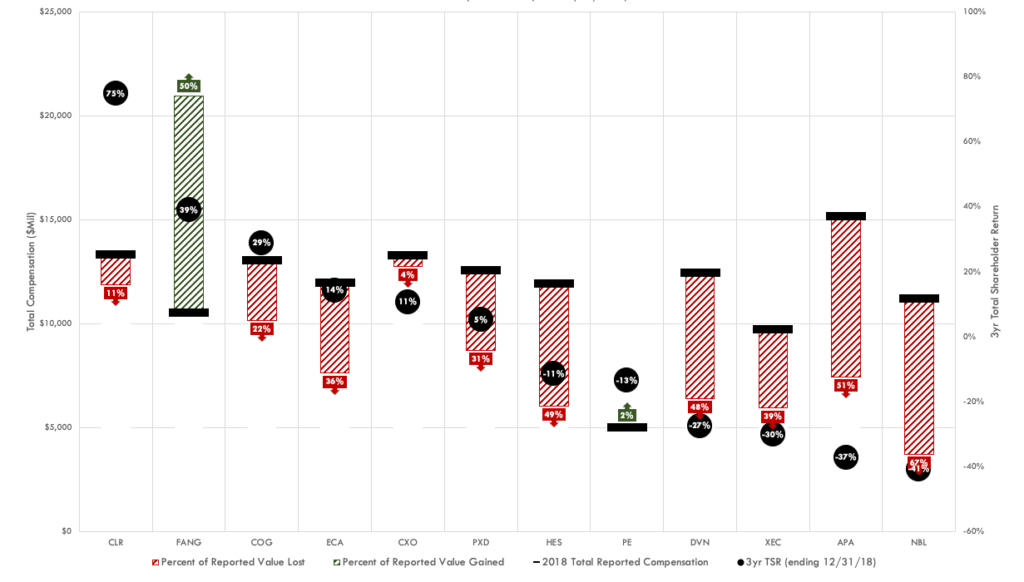

TOTAL CEO COMPENSATION (FY2018) | $5B – $25B Market Cap

Realized vs. Reported Value (as of 12/31/2018)

Median 3yr TSR: -3% | Realized as % of SCT: 67%

Reported Value Methodology – Total Compensation Reported in FY2018 proxy statement.

Realized Value Methodology –Sum of FY2018: Base Salary, Bonus, Non-Equity Incentive Plan Compensation, Change in Pension Value and Non-Qualified Deferred Compensation Earnings, All Other Compensation, and total vested shares at 12/31/2018 adjusted closing stock price.

1. Source: Rystad Energy | April 2, 2019