Compensation in the Real Estate Industry

Introduction

The pandemic has significantly impacted the real estate sector. With a surge in the number of employees who work from home, the demand for office space has softened. At the same time, growth in e-commerce has exploded, resulting in further disruption of traditional retail business. As the post-COVID effects of the pandemic continue to plague the real estate market, we can prepare for changes in compensation and strategies in the interim adjustment period.

As companies and boards begin to make compensation decisions for 2021, NFPCC has reviewed the progression of compensation across multiple positions within the real estate industry relative to overall sector performance through shareholder value generation. Specifically, in this month’s article we analyze compensation changes within the sector from 2018 to 2020 and the future outlook for the real estate industry.

Real Estate Compensation & Incentives

Real Estate Base Salaries Show Steady Increase

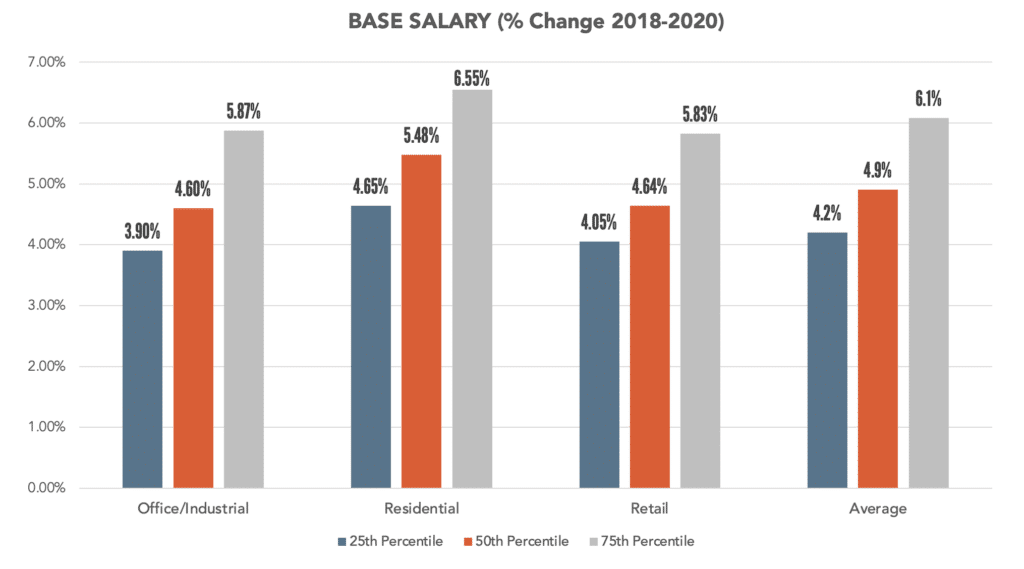

Despite 2020 going through a tremendous number of changes due to the on-going pandemic, base salary compensation in the real estate sector has continued to increase. NFPCC concludes that the continued increase in base salary compensation, in most cases, was due to decisions that were already made prior to the threat of the pandemic. Most compensation decisions are established right before or shortly after ringing in the new year. To better understand the changes from 2018 to 2020, we have illustrated below the percent change in base salary compensation at each percentile for the separate sub-sectors of real estate; specifically, office/industrial, residential, retail, and the aggregate average of the sub-sectors.

From the chart above, NFPCC has analyzed the base salary difference between 2018 and 2020 at each the 25th, 50th, and 75th percentile to better understand compensation decisions within the last three years. Regardless of which sub-sector of the industry a company operates in there has been a steady continued increase in base salary at each percentile. Residential has seen the largest base salary increase at each percentile with office/industrial and retail being similar. On average, base salary increases have been 4.2%, 4.9% and 6.1% at the 25th, 50th, and 75th percentiles respectively.

Total Cash Compensation

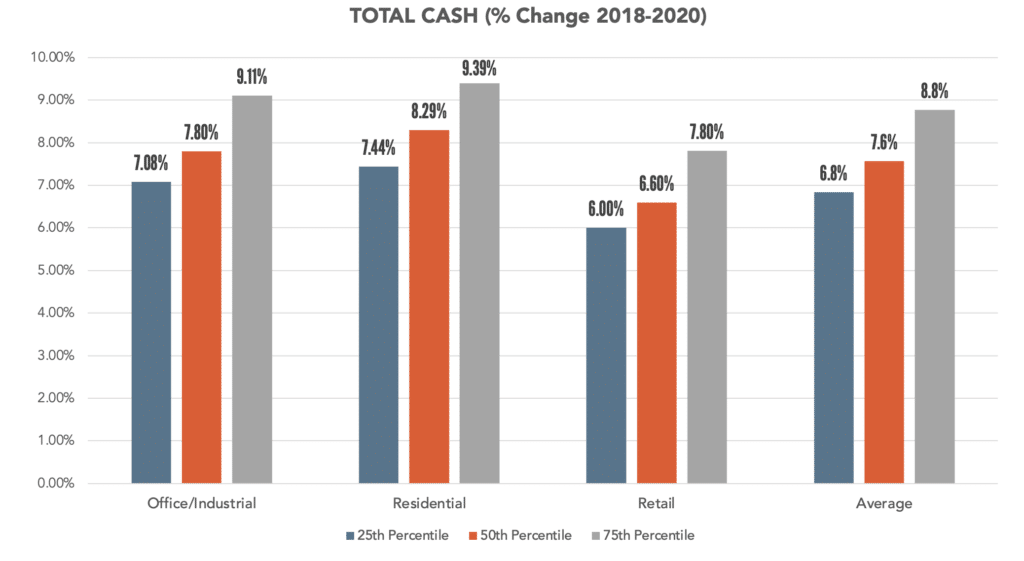

Base salary is just one component to total cash. NFPCC also analyzed total cash compensation (base salary + bonus) to determine if there were any substantial changes over the last few years. At the time of this article, we are unable to capture exactly what has happened in the industry for 2020 bonus programs, however, we can analyze bonuses paid in 2020 as COVID-19 was beginning to have unprecedented impact. As real estate continued to see growth up until January 2020 it is no surprise to see companies pay out larger bonus amounts or percentages. Below is a graph that illustrates the total cash percent change from 2018 to 2020.

The chart above depicts that every industry saw increased movement in total cash at each percentile with an average of 6.8%, 7.6%, and 8.8% at the 25th, 50th, and 75th percentile respectively.

Value to Shareholder

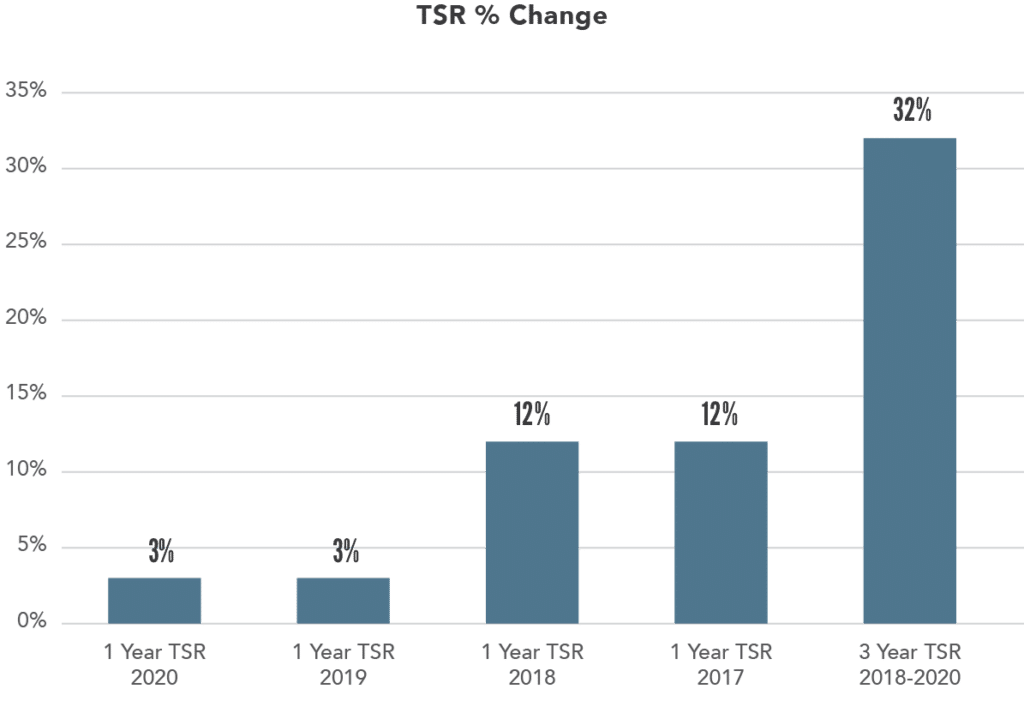

In relation to compensation – performance, primarily through shareholder value generated – is viewed as inclusive of one another. Similar to compensation, over the last five years, total shareholder return has continued to climb at a slow but increasingly steady rate upwards. From 2019 to 2020, total returns exploded within the real estate industry until COVID-19 hit in early 2020. During the early to middle part of 2020, total returns reverted back to a state of 2016 return levels; however, NFPCC is observing a rebound over the last several months which is producing a positive outlook for real estate as we enter the early stages of 2021.

Future Outlook

Although positive movements are being made in vaccination availability and participation, the outlook for 2021 remains uncertain. All sectors of the real estate industry are being affected by the pandemic and are facing many question marks. However, based on real time discussions with board members and key members of management across our real estate clients, NFPCC expects companies in the industry to monitor projections of full year results and economic recovery before providing widespread increases in compensation, with the exception of incumbents that are newly promoted or below market.

Conclusion

The real estate industry will be transformed as it has after other black swan events such as the S&L debacle, the tech bust, 9/11, and the Great Recession. There will be winners and losers. The depth and breadth of it depend upon the government’s ability to bring public health back to some form of normality and restore confidence, and the length of the economic recession and recovery. Real estate lags the overall economy, so it will need to follow suit and determine how to reinvent itself to aid in the recovery and the growth of the nation. But in the end, being able to attract, retain and motivate top talent will be the key differentiator!

Don’t hesitate to reach out to us for help with your strategy and compensation planning. Visit our real estate page for more information on our expertise and capabilities in this sector.