Compensation Risk Assessments

Incentive compensation holds an important yet unique place within a company’s pay program initiatives. Both long and short-term incentive plans should be designed to balance attracting and retaining top-level talent in conjunction with motivating behaviors to achieve a company’s strategic, operational, and financial performance goals; however, often times these programs can pose significant risk to a company if not designed well.

Why Conduct Compensation Risk Assessments?

Following the end of 2009, the Securities and Exchange Commission (SEC) required public company proxy filings to include disclosures on any practices and policies related to compensation posing material risk to a company. This required disclosure regulated by the SEC, predominantly for publicly traded companies, refers to published results of a Compensation Risk Assessment. Such an assessment serves as a review of the practices and policies surrounding compensation and governance to evaluate if any material risk is placed on an organization.

Assessing Risks in Executive Compensation

The passage of the Dodd-Frank Act on July 21, 2010, ushered in many new regulations specific to executive compensation. The most notable and potentially damaging regulation is the non-binding shareholder Say-on-Pay vote. The Dodd-Frank Act also has other provisions related to executive compensation that ties into a company’s compensation risk profile, including:

- The requirement of independence for compensation committee members;

- Consideration of the committee advisor’s independence;

- Pay-for-performance disclosure;

- Internal pay equity disclosure;

- Say-on-Golden parachutes; and

- Disclosure of clawback policies

Any operational or financial metric goal can inadvertently produce risk to a company or its shareholders. Board members must stay vigilant and establish a sound process to mitigate any risk potential relating to retention, financial, operational, or reputational practices. While a Board should motivate a high level of performance within their leadership team, there must be a balance of reasonable behavior to achieve success for an organization year over year.

Elements of a Thorough Compensation Risk Assessment

The intent of executive compensation risk assessments is to highlight specific elements of executive compensation that might induce executives to pursue high-risk strategies that could lead to harmful operational, financial, or performance shortfalls, and threaten the Company’s long-term viability. A thorough risk assessment process should include the following steps:

- Project Organization. Determine the appropriate team members and scope of the assessment. This usually includes the Compensation Committee, General Counsel, VP of Human Resources, and Chief Risk Officer (if applicable). Also, determine what will materially impact the Company.

- Conduct the Risk Assessment. Review each specific step in the compensation setting process and each component of compensation for practices or programs that have the potential to entice risk-taking.

- Determine Risk Mitigation Techniques. Once the potential risks have been identified, create a plan to adjust areas that are determined by the Committee to be too high risk.

- Monitor the Results. Risk assessments should be performed annually, and the changes tracked year to year to ensure the proper decisions have been made to mitigate potentially risky behavior.

While companies are required to disclose any perceived risk, details are only required if there is a significant risk present, excluding any potential risk that might arise. NFPCC believes that checking a box is not a sufficient practice – a more thorough analysis is required to ensure every detail is examined. As such, companies must extensively evaluate metrics utilized to balance company success and minimize negative future impacts.

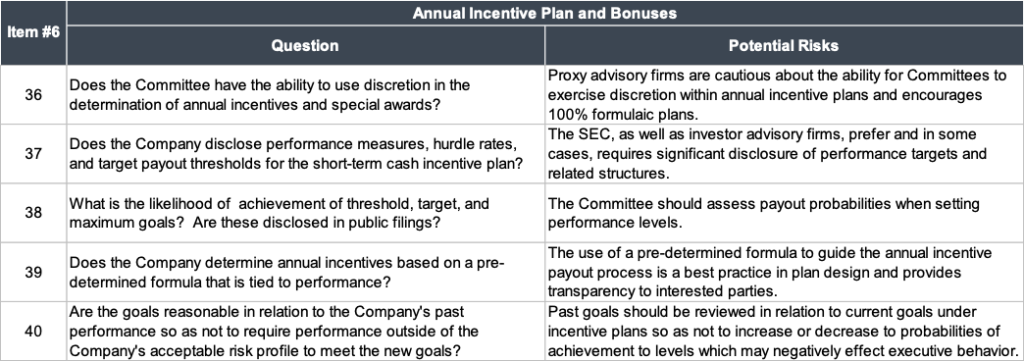

NFPCC notes that there are generally ten specific categories of risk related to compensation and governance assessments; from peer group composition to incentive plan structures to employment agreements, all angles need to be reviewed carefully. Below is a snapshot out of nearly one hundred pointed questions NFPCC seeks to answer when conducting a thorough Compensation Risk Assessment:

Third-party consultants play a valuable role in providing guidance and support to companies in evaluating compensation programs to maximize their talent and organizational success for current and future years. While some level of risk is vital for businesses to thrive, NFPCC can help identify and address any red flags that may promote undue risk-taking. Contact NFPCC for more information regarding Compensation Risk Assessments, as it is important that no stone is left unturned.