Following Inflation & Compensation

It has been decades since Americans have experienced record high inflation. Macroeconomic conditions, monetary policy, and a long list of other factors have caused inflation to rise around 8.6% over the last 12 months, and the consensus is inflation will continue to trend higher. Inflation is projected to increase to about 9% by the end of summer followed by a gradual decline. As the months go by, consumers are becoming hyper-aware of the decline in their respective purchasing power. Employees are becoming increasingly concerned with this reality and continue to expect more from their employers; higher increases in salaries to help with the rising cost of living, and ways of offsetting expenses (travel to an office, parking, etc.). Employers have also been feeling the pressure as the struggle to attract and retain talent continues at a fever pitch.

Understanding the Correlation between Inflation & Compensation

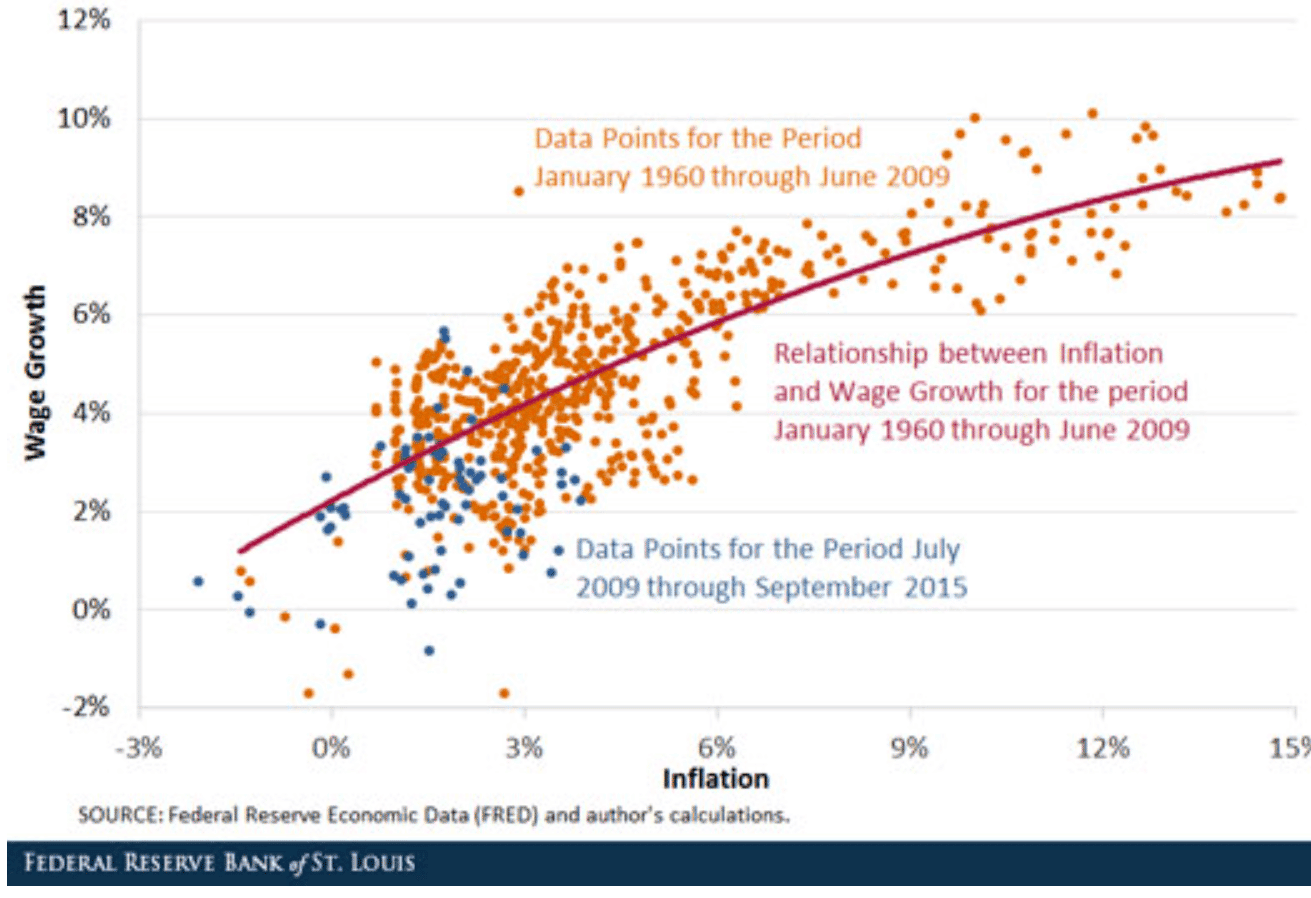

The past 2 years have not been easy on the labor market. Companies are still grappling with the lingering effects of a tight labor market. Adding record inflation into the mix only adds more chaos and moving targets. Based on recent forecasted figures, compensation will trend upwards to nearly 4-5% increase in salary towards the beginning of 2023, an increase of 2-3 basis points over previous years’ averages, an expected outcome based on the convergence of diminished purchasing power and the talent shortage. The chart below illustrates the historical relationship and trendline between inflation and wage growth. The illustration shows a positive slope, indicating that as inflation increases wages typically rise. However, as inflation increases past the 6% mark, the slope of the line begins to decline, meaning wage growth begins to lose the correlation. It is unlikely for pay increases to keep pace with high inflation rates such as the ones we are experiencing now. Many companies understand the concept of fixed expense via salaries. Any adjustment to base salary levels becomes the new standard for a given position; thus, increasing the fixed expense a company must account for in each pay period.

Inflation & Wage Growth

Strategies to Manage Inflation & Increase Retention

Needless to say, companies are faced with multiple challenges concerning salary budgets and increased labor costs, pay compression, and attraction and retention issues. At this point halfway through the year, if any organization aims to stay competitive, attract, and retain top talent it is critical to review its compensation plans and make the necessary adjustments to ensure employees are receiving wages that factor in today’s economic climate. Awarding bonuses may be a good alternative to increasing salaries, and many companies are implementing this strategy. Advisory firm Wills Tower Watson recently recorded that bonuses were on average 39.5% higher for top executives than the previous year. Alternatively, generous salary increases focused on top performers might be a better solution for achieving long-term retention. Apart from setting competitive pay, companies should consider the total employee experience to supplement compensation.

The effects of high inflation will be with us for some time and employees’ expectations for higher wages will continue. Companies will need to work harder to manage labor costs while staying competitive regarding recruiting and retaining high-quality employees.

NFP’s compensation consultants are ready to assist you in developing an effective compensation strategy for these turbulent times. Complete the form below to get started.