Pre-Petition Retention Awards: Important Tools or Excuses for Excessive Compensation?

/

BANKRUPTCY COMPENSATION

The concept of excessive executive compensation is a seemingly frequent topic that garners significant reaction regardless of personal viewpoints. The essence of the topic is intended to elicit a moral response, asking us to question fairness in the context of our own situations. Everyone seeks what is fair (not to be confused with equal) believing that a correlation between individual performance and realized income should be an ever-present compensation characteristic. But what happens when a company is failing or on the edge/moving toward bankruptcy? An immediate reaction is viewing this as a failure, and failure should at the very worst mean termination or at best significantly reduced compensation opportunity…right? Unfortunately, it is not that simple or straightforward.

///////

Record-Breaking Bankruptcies in 2020

The current state of the U.S. and the global economy is precarious. According to a recent Chicago Tribune article, there is likely a tidal wave of bankruptcies on the horizon for 2020, following an already over-active year. It is expected that 2020 will surpass the bankruptcy record set in 2008. Although the brunt of this is correlated to COVID-19’s impact on the global markets, OPEC-related actions by Russia contributed to oil price crashes which generated an influx of energy restructurings. All the experts agree that the coming tidal wave will swamp the system and result in the failure of many of these companies to survive. As such, it is incumbent of the leadership of these companies to react quickly in order to salvage as much value for creditors as possible, or potentially avoid a fall into bankruptcy altogether.

Re-thinking Bankruptcy Compensation

In the past, much of the blame for failed businesses fell on the shoulders of the executives leading them. Poor decision making, over-leveraging the balance sheet, and imprudent use of capital resulted in poor financial performance and an ultimate decline of the business. In many of these cases, executives were replaced. However, the majority of recent bankruptcies have been a direct result of macro-economic issues which were largely outside of executive control. This has resulted, in most cases, in the desire to retain executives through the restructuring, with the intention of having them continue running the business upon emergence. This strategic shift necessitated a re-thinking in the approach to bankruptcy compensation.

KEIPs Vs. KERPs

Executive performance leading up to and through a bankruptcy remains vitally important to future success; however, a major shift in “pay-for-performance” in the context of restructuring has occurred. With the change in bankruptcy code in 2005, specifically, the institution of 503c, the structure of executive compensation through bankruptcy had to change. No longer was the concept of retention within the restructuring period allowed. Rather, insider executives are now required to be subjected to performance-based incentive plans, most often referred to as Key Employee Incentive Plans (“KEIP”). These plans, while still used today, albeit to a lesser extent, were mainly applicable for executives in instances where they were not likely the surviving executive post-bankruptcy. The issue with KEIPs in a retention-focused scenario is the often significantly reduced total compensation opportunity coupled with a higher risk of forfeiture. This makes these programs disincentivizing as stand-alone programs. To combat this, the pre-petition retention program was developed. This structure, most commonly referred to as a Key Employee Retention Plan (“KERP”), avoids bankruptcy court oversight/approval in instances where insiders are receiving payments, falling under business judgment rules preceding a bankruptcy.

Although this is a commonly used program in today’s bankruptcy preparation strategy, it is increasingly being used as a stand-alone program, with many companies attempting to deliver normal aggregated total compensation through these programs with little or no diminishment from the normal value. In theory, this sounds appropriate, given the fact that executives are working harder and should maintain a competitive compensation program through restructuring. However, the time and risk differential of the normal course of business programs relative to short-term restructuring programs cannot and should not be ignored. The value, which is guaranteed to be received up-front, is subjected to short-term recoupment provisions, has no performance contingencies, and must be discounted to account for a variance to high-risk high-value programs which are longer-term in nature.

Reasonable or Excessive Awards?

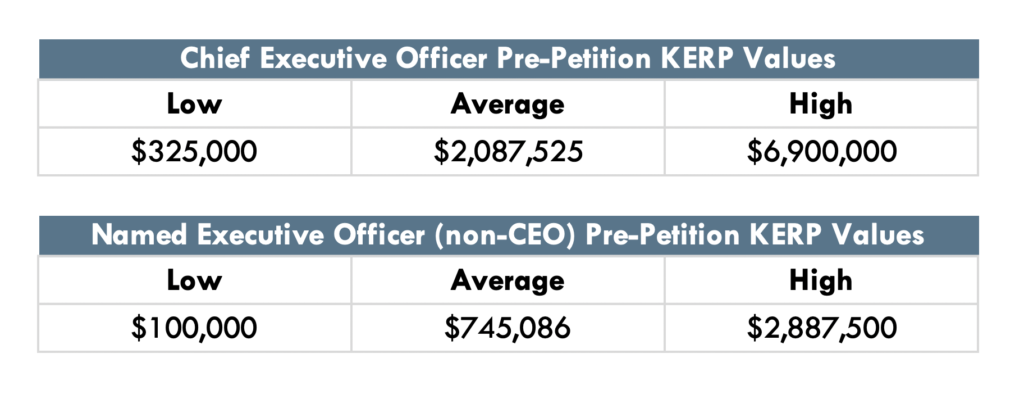

The real question this article seeks to answer is whether the values being provided through these pre-petition award structures for insider executives are reasonable or even necessary in light of the current state of the economy; or are they simply a means to unduly enrich executives without any mandated performance expectations. Let’s take a look at the current state of the market:

- In a review of 32 recent pre-petition KERPs, where no associated KEIP was present, the average CEO maintained 83% of their normal pre-bankruptcy total compensation value. This includes long-term equity awards. Other executives maintained an average of 78%. In some cases, the individual value delta was significantly greater due to time/risk adjustments being applied to long-term incentive opportunities. The largest delta was -76%.

- According to Equilar, as of May 2020, 452 companies, had adjusted executive pay by way of either base salary, bonus, or long-term incentive adjustments. Although these pay decreases and the plummeting of market values signal trouble for the broader economy, many companies are poised to weather the storm and emerge from the fray without having to restructure. For those less fortunate, bankruptcy may be the only option.

- 2020 is expected to surpass the 2008 bankruptcy record. Never before have so many household names filed for bankruptcy in the same year. J. Crew, Hertz, 24 Hour Fitness, Tailored Brands, and many more are left with too much debt and dwindling income as a result of the COVID-19 impact. To date, there have been a total of 3,604 bankruptcies in 2020.

- In the realm of executive search, it is hard to argue against the lull in executive placements. However, according to a single leading search firm in the energy sector, there remains a high level of interest in the opportunistic hiring of key executive positions. Currently, this single firm has over 50 open searches, with 2 of those being for CEOs. There are two things to consider here: i) open searches are not being canceled, but rather these companies remain interested in filling positions; and ii) while new search requests are down currently, there is projected to be a surge following a return to normal business.

According to a recent Shortlist interview of Russell Reynolds, a prominent search firm, “The crisis has heightened the need for good leadership, and some searches have accelerated because organizations need that capability now.’” - In a review of 32 recent pre-petition KERPs, where no associated KEIP was present, the average CEO maintained 83% of their normal pre-bankruptcy total compensation value. This includes long-term equity awards. Other executives maintained an average of 78%. In some cases, the individual value delta was significantly greater due to time/risk adjustments being applied to long-term incentive opportunities. The largest delta was -76%.

In 8 of these cases, CEOs maintained 100% of their total compensation value delivered in a typical annual cycle in the way of a guaranteed retention bonus, while the remaining 24 experienced varying degrees of lesser value. There were a few instances where significant reductions occurred. In all of these cases, the only stipulation regarding the payment was a clawback policy in the event of voluntary or for-cause termination.

As discussed later in this article, there are many considerations that must be accounted for when developing these programs to ensure reasonableness is balanced with effectiveness. However, the most overt and controversial issue is the determination of proper value delivery. There are significant examples of properly structured programs where the correct approach to value delivery was applied. These boards and advisors worked to ensure a competitive program was put in place that was effective in its goal of retention, while also being reasonable in light of the value being delivered over a short-term period. Unfortunately, there are examples where advisors have developed programs, which are ultimately approved by the board, that are blatantly unreasonable. These programs provide an enticing proposition to executives…the promise of multi-million dollar guaranteed cash, equal to summary compensation table annual value, in a single year period. This is ludicrous.

Every company is not only currently assessing its financial position in light of the economy, but also building business continuity and long-term strategic plans to ensure future success. One of the most important factors of the assessment is the executive leadership’s position in the new entity. As mentioned previously, the market has not experienced widespread executive turnover as a result of the poor market conditions, even in bankruptcy situations. Quite to the contrary, most companies are resolving to stick with current management, in order not to exacerbate problems by layering on a change in leadership. This coupled with a still active executive search environment creates the need to retain executives through volatile and uncertain times. With the understanding that executive search firms remain busy during this time, ensuring executives are focused on their current situation, not fielding calls related to other opportunities, should remain a key focus.

Considerations for Boards Entering Bankruptcy

Given all of these facts, two conclusions can be drawn: 1) although the market is tough, executives with significant experience remain highly marketable commodities with options. Therefore, retention must remain a concern for boards seeking to ensure continuity of the management team. 2) The approach to KERP development in the market varies significantly, with the majority of organizations providing reasonable compensation levels in light of the time and risk variance as a normal course of business. On the other hand, there are examples of abuse which cast a negative light on pre-petition KERPs in general. The importance of establishing the right KERP becomes paramount.

What then should a board potentially entering bankruptcy consider in light of this decision and how do they incentivize an executive to stay when other less risky, yet interesting opportunities present themselves?

- Determine the timeline of events. If sufficient time remains before a filing event, there are greater alternatives with lower risk. In the event restructuring is imminent, pre-petition compensation arrangements for executives carry a higher risk of Section 548 clawbacks related to fraudulent transfers.

- If the pre-petition KERP is viable from a timing perspective, consider whether any during-petition compensation arrangements, such as KEIPs, will be contemplated. The utilization of these 503c compliant plans creates significantly greater burdens to ensure compliance but may be the better route given company-specific facts and circumstances.

- The pre-petition KERP may appear at face value to be anti-shareholder/creditor friendly. The reality, however, is that the structure of this compensation vehicle serves to provide stability to the business by applying significant handcuffs to executive recipients. The very structure of upfront payments, with associated clawbacks, makes leaving an onerous task, as repayment of significant value is often unpalatable. Keep in mind, executive turnover in bankruptcy situations where pre-petition KERPs have been utilized is less than 1%, speaking volumes about the effectiveness of the retention characteristics of these programs. There is no better vehicle if retention is the goal.

- Ensure the value and clawback period coincide. There should remain a correlation in the value delivered and the lapsing of clawback restrictions to ensure the proper value is delivered relative to the time of retention.

The development of effective pre-bankruptcy compensation programs takes into account multiple factors. Accounting for each of these ensures a higher degree of success at retaining executives and ensuring creditors, the UST, and other constituents view the program as reasonable. Abuses have occurred, and excessive compensation levels have been delivered, but these are the minority. The majority of pre-petition KERPs remain reasonable and were approached with thoughtfulness. There is value in considering this option, as it may be the best single retention tool in the pre-bankruptcy tool belt.

NFPCC Can Help

NFP Compensation Consulting has successfully assisted dozens of organizations through restructurings, reorganizations, workouts, bankruptcies, insolvencies and other matters involving financially distressed transactions. With extensive experience as corporate restructuring consultants, NFPCC’s leadership is positioned to develop unique programs that retain key talent, incentivize employees to achieve goals which are integral to successful emergence, and ensure competitiveness of compensation values that fit within the cash flow requirement of the company. If your organization is faced with the difficult decision of bankruptcy, you need a trusted advisor at your side to guide you through the process. Learn more about our restructuring capabilities or contact us below to get started.