Renewed Focus on Executive Pay for Performance

It’s been nearly twelve years since The Dodd-Frank Act was enacted as a direct response to the financial crisis of 2008. The Act holds many sections detailing regulations to be enforced; however, a recent resurgence of proposed pay for performance mandates from 2015 have surfaced and are, once again, in the spotlight for consideration by the SEC.

What is Pay for Performance?

Pay for performance was coined to define the expectations of executive pay in the form of annual and long-term incentives and how incentive pay should correspond to company performance and in turn promote shareholder returns. While pay for performance has been a hot discussion for many years, perfecting the practice has been both challenging and controversial. The ever-changing market landscape has led to an ongoing debate over what practices achieve the ideal correlation between performance and executive pay. Regardless of the endless perspectives, it’s important for companies to ensure appropriate steps are taken to develop pay programs that link incentive compensation to performance.

Although the Dodd-Frank Act focuses on publicly traded companies, private companies and many not-for-profits continue to develop programs that utilize corporate and individual performance metrics to determine incentive compensation. Investors and employee advocates have long awaited more details on how companies incentivize the labor force, primarily executives. Finding the “perfect” balance will be difficult as market conditions evolve and internal and external perspectives continue to shift.

SEC Reopens Comments for Pay Vs Performance Rule

The SEC has recently opened a new comment period for the amended rule under the Dodd-Frank Act relating to pay for performance for executive officers. Within the proposed rules, publicly held companies would be required to expand their executive compensation disclosures by providing more information within the Compensation Discussion and Analysis (“CD&A”) section of their proxy statement. These amendments tie back to the proposed rules that were first brought to light in May of 2015.

To obtain full transparency, the SEC is proposing that companies describe the exact executive compensation paid related to financial performance over the time horizon of the disclosure. These proposed adjustments will require additional tabular disclosures to be included within the CD&A; specifically, the following:

- Summary Compensation Table Total;

- Compensation Actually Paid;

- Average Summary Compensation Table Total for non-peo NEO

- Average Compensation actually paid to non-peo NEO;

- TSR; and

- Peer Group TSR.

In particular, cumulative total shareholder return (“TSR”) would be the preferred measure for financial performance. While TSR is a prevalent performance measure, there are many benefits to utilizing this metric, including the following:

- Easily and consistently calculated.

- Objectively determinable without subjective determinations.

- Disclosure is currently required, and shareholders are already familiar.

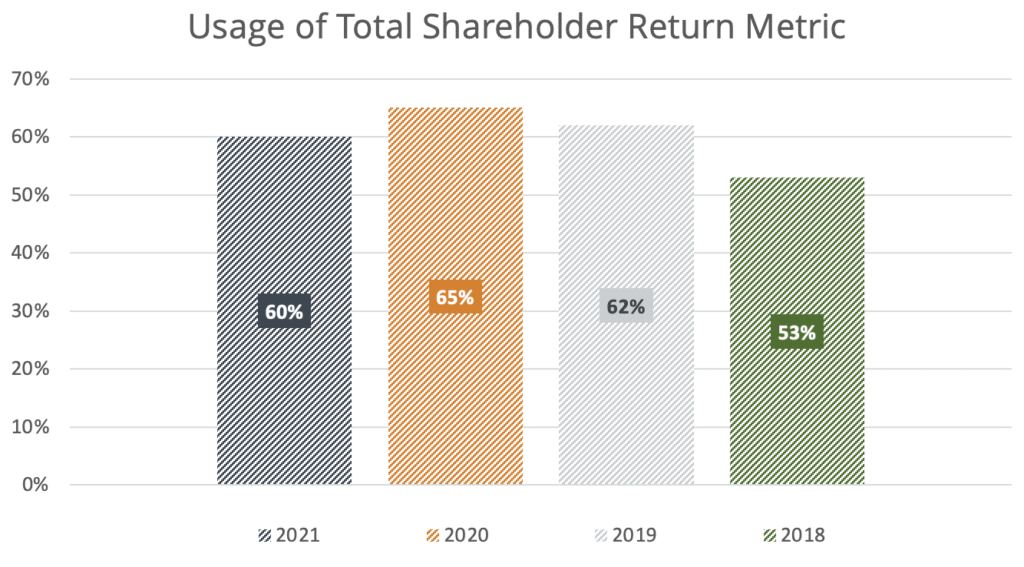

According to Meridian, TSR has remained the most prevalent long-term performance measure over the last several years given its transparency, alignment with shareholder interest, and ease of setting multi-year goals.

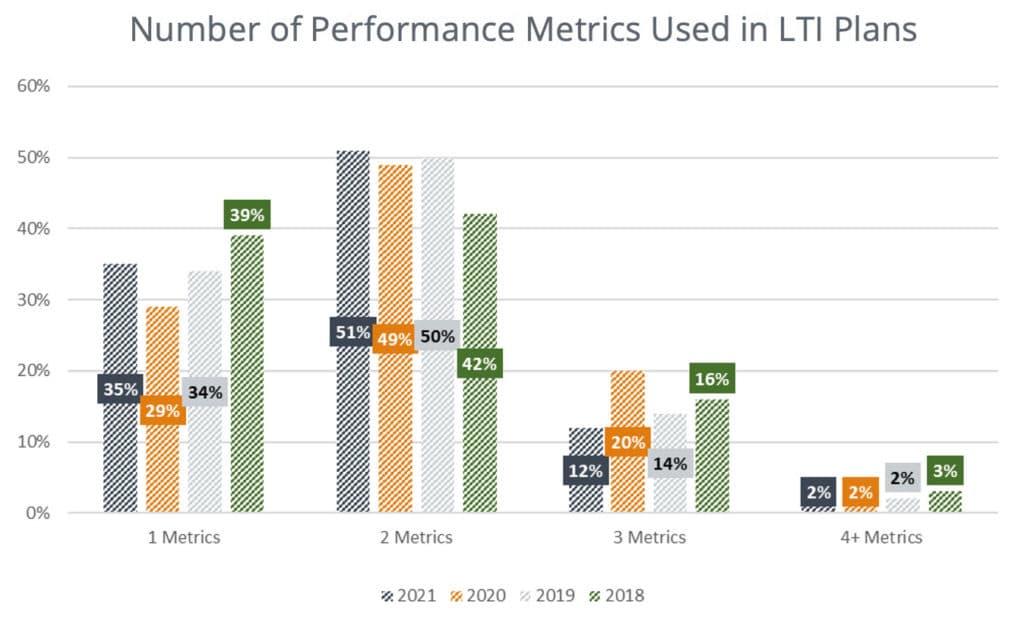

While the single usage of TSR remains the most prevalent measure, there has been a sharp uptick in implementing multiple performance metrics over the last three years, according to Meridian.

Conclusion

Regardless of company status: public, private, or not-for-profit, pay for performance will continue to remain as the focus point in executive compensation programs for a long time to come. Developing a program that properly correlates performance to the shareholders will continuously evolve over time. Ensuring that proper efforts, measures, discussions, and independent counsel will provide the best basis for compensation plan design.

If you have any comments to share with the SEC be sure to visit: https://www.sec.gov/regulatory-actions/how-to-submit-comments

Source: https://www.sec.gov/rules/proposed/2022/34-94074.pdf

Meridian 2018, 2019, 2020, 2021 trends and developments.