Should TSR Performance Be Accounted for in Annual Incentive Plans?

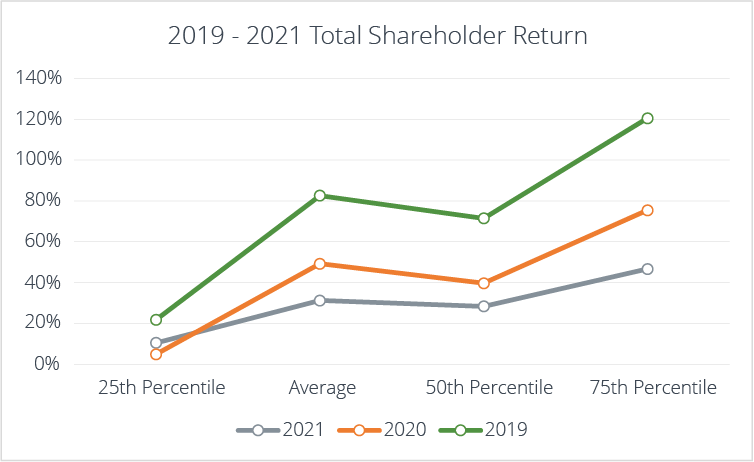

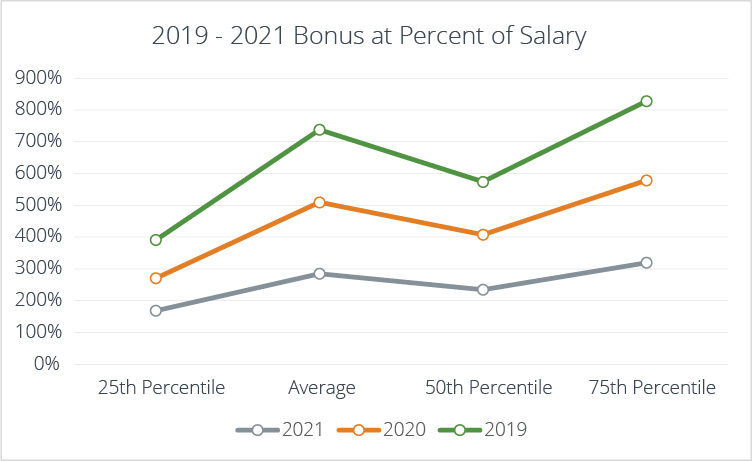

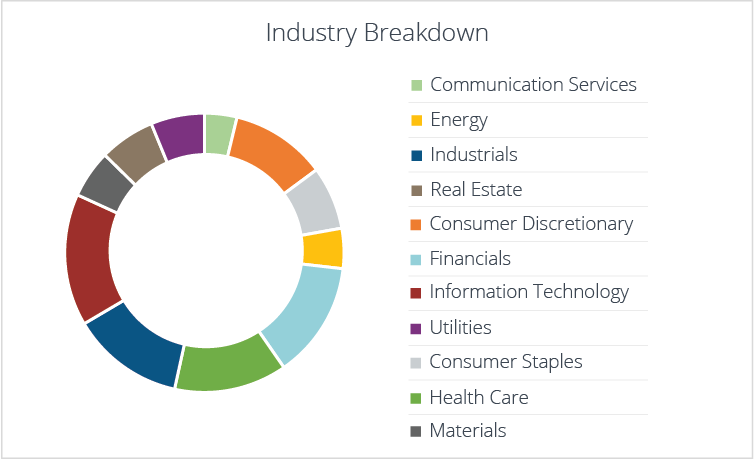

It’s that time of year again as calendar year organizations begin to finalize their respective annual incentive/bonus payouts. Within this context, many board members and directors, in their totality, are wrestling with investor perspectives and pre-determined performance metrics. This convergence of thought processes has been a continued hot-button topic covering the previous five years. Within this article, NFPCC analyzed recent multiyear annual incentive/bonus payouts in relation to annual total shareholder return (“TSR”) calculations for the S&P 500. Specifically, NFPCC analyzed CEO annual incentive/bonus pay in the correlating years in which total shareholder return was measured. Under this assessment the years in review were 2021, 2020 and 2019. NFPCC expects to review 2022 results upon the completion of 2023 proxy filings.

Intent of Annual Incentives

Before analyzing the linkage, when/where one may exist, it is important to understand the philosophical approach to WHY organizations use annual incentive programs in the first place. Data and best practices from leading Human Resources advocacy groups and professional accrediting bodies have taught that the general purpose of an annual incentive plan is to measure and judge annual objectives and their responding successes/failures. Generally speaking, annual incentive plans are designed with these annual performance hurdles (mid-to-short term) in mind. These time horizons are typically 6-12 months in length, thus the “ANNUAL” within annual incentive. Adapting Newton’s law of motion, every action has a correlated reaction. As such, these actions (annual hurdles or objectives) serve as building blocks for long-term viability and success (reaction based on the beginning action or actions). However, directly linking stock price performance to executive action is impossible. Frankly speaking, if an executive officer could directly impact the price of a given stock or value of the Company, that individual would have infinite leverage within any and all organizations. Realistically, stock prices are determined by extraneous market factors, outside of the control of Management, the general employee, or the Board of Directors, creating a lack of direct line of sight within a short-time period. Exceptions to this philosophy include negligence, fraud, and other restatements of information or public perception.

Is There a Link Between Annual Incentive Payouts and Actual TSR?

Within this analysis, and the illustrations below, actual annual incentives/bonuses are correlated to TSR. Inherently, as company TSR performs Management incentive compensation tracks across all percentiles. The below illustrations, if layered on top of each other, would appear as though labels were transposed or data was misinterpreted, yet the resulting data output has shown that in years 2021, 2020 and 2019, there is a direct correlation.

What many may be asking is what does this tell us or how should it impact our thinking? In short, through a review of the program plans/metrics of the companies included within the S&P 500, NFPCC can comfortably state that the overwhelming majority do not include TSR as a direct metric of observation within their plans for annual incentives (yet the overwhelming majority do use TSR in their long-term incentive plan). These annual incentive plans are structured around financial and operational goals that are discussed and vetted annually and are oftentimes a part of every compensation committee meeting to discuss trends and how closely the company is tracking to plan. Meaning, Management teams and their Board of Directors are more than fulfilling their duties to their respective organizations in the aggregate without placing uncontrollable factors into a formula.

Conclusion

In closing, NFPCC understands that Management and the Board of Directors are ultimately striving to maximize shareholder value and shareholder relations, as they themselves are shareholders of companies, creating a linkage of interests over the long term.

NFPCC’s executive compensation experts are ready to assist you in crafting an effective plan that will create long-term value and growth. Contact us today to get started.